The Microchip Dilemma: Why the U.S. Must Diversify Its Sources

Taiwan produces over 60% of the world’s semiconductors, with Taiwan Semiconductor Manufacturing Company (TSMC) being the largest and most advanced chipmaker globally. TSMC alone accounts for nearly 90% of advanced chip production, making Taiwan indispensable to industries like electronics, automotive, and defense.

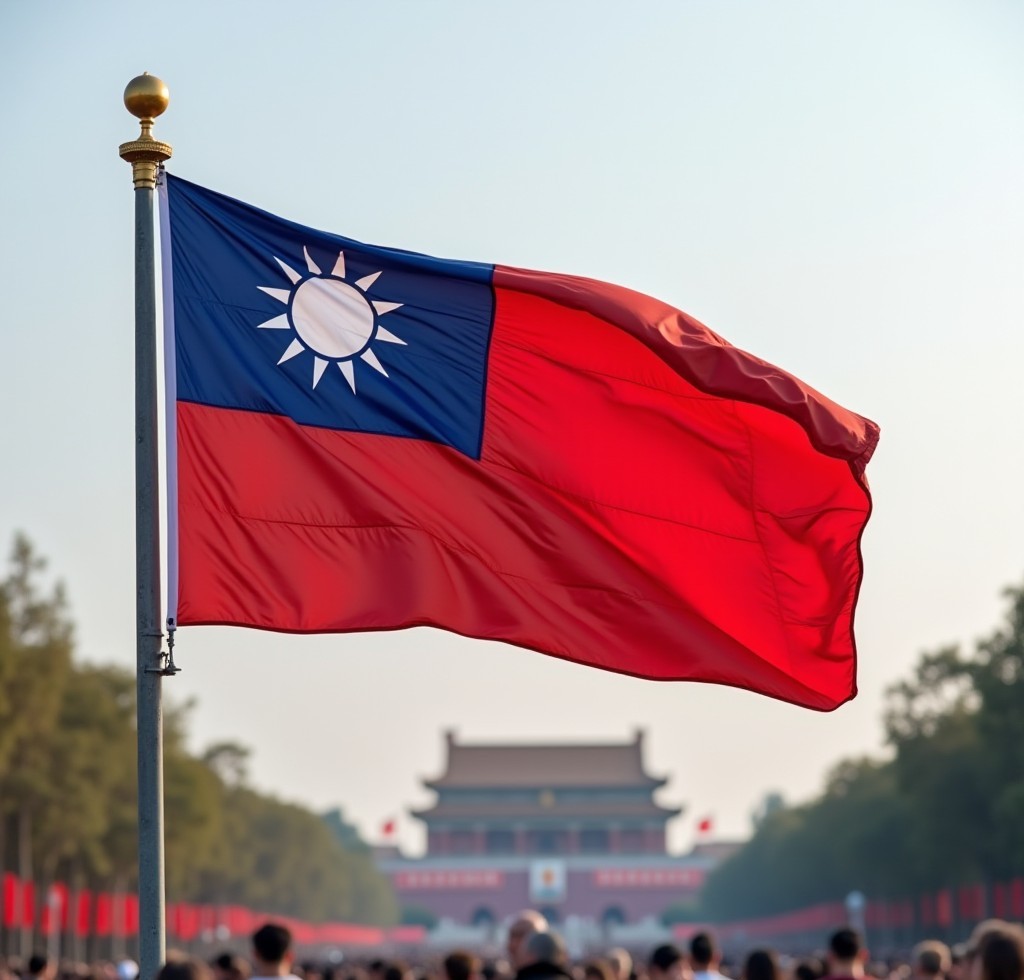

The global demand for microchips is growing at an unprecedented rate. Microchips, or semiconductors, are integral to nearly every aspect of modern life, from smartphones and electric vehicles to artificial intelligence and healthcare technologies. However, despite their critical importance, the United States remains heavily reliant on Taiwan for microchip production. This dependence has become increasingly risky due to geopolitical tensions, environmental factors, and the vulnerability of global supply chains. As the world’s leading supplier of high-performance semiconductors, Taiwan’s dominance is creating a supply chain bottleneck that has far-reaching consequences for the U.S. economy and national security. In this article, we explore why diversifying the United States’ microchip supply chain is essential and what steps are necessary to secure a more resilient future.

Understanding the Current Microchip Landscape

Microchips are the backbone of the modern technological world, enabling everything from consumer electronics to critical infrastructure. These tiny components power the devices we use daily and are also central to the development of new technologies such as artificial intelligence, 5G connectivity, and autonomous vehicles. The semiconductor market is enormous, valued in the trillions of dollars, and as demand for advanced electronics grows, so too does the demand for microchips.

Taiwan is currently at the center of global semiconductor production. Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest contract chipmaker, produces more than half of the world’s microchips, including those used in everything from smartphones to defense systems. Given its technological expertise and infrastructure, TSMC has become the dominant player in the semiconductor industry. However, Taiwan's geographic and political location presents significant risks. The island lies in a region where geopolitical tensions are high, particularly between China and Taiwan. This instability poses a serious threat to the global microchip supply chain, leaving the United States—and much of the world—vulnerable to potential disruptions.

The Risks of Overdependence on Taiwan

Relying on a single country for critical components, especially one with such high geopolitical stakes, creates significant vulnerabilities. Taiwan’s political situation is tenuous, and the growing tension between China and Taiwan presents a real threat. China views Taiwan as part of its territory, and any military escalation, economic blockade, or other disruptions in the region could halt microchip production entirely. A disruption in Taiwan would create a ripple effect, potentially bringing global supply chains to a standstill.

Furthermore, Taiwan is located in an area prone to natural disasters, including typhoons and earthquakes. These environmental risks pose an additional threat to the continuity of chip production. The COVID-19 pandemic only underscored the fragility of global supply chains. During the pandemic, industries worldwide faced severe microchip shortages that delayed production and increased costs. For the United States, these disruptions revealed just how deeply the economy and technology sectors depend on a few key players in Taiwan, further highlighting the need for diversification.

The Economic and Security Implications for the U.S.

The U.S. economy is intricately linked to the semiconductor industry. From consumer electronics to automobiles, nearly every sector depends on microchips to function. In recent years, global semiconductor shortages have caused massive economic disruptions. For instance, the shortage of chips during the pandemic caused significant delays and losses in the automotive sector, costing U.S. automakers billions of dollars. The semiconductor crisis not only delayed product launches but also raised prices for goods that rely on chips, impacting both businesses and consumers.

National security is another critical concern. The U.S. military relies on advanced semiconductors for defense systems, communications, cybersecurity, and intelligence. Any disruption in microchip supply could severely weaken the country’s defense capabilities, leaving it vulnerable in a rapidly changing global landscape. The U.S. must safeguard its technological infrastructure from foreign influence, as reliance on a single foreign country for such a vital component compromises national security.

Additionally, without a diversified supply chain, the U.S. risks losing its competitive edge in global technological innovation. As countries like China and South Korea invest heavily in semiconductor development, the U.S. may fall behind in the race for cutting-edge technologies, such as quantum computing, AI, and next-generation wireless communication. Without secure and diversified sources of microchips, America could lose its technological leadership, and by extension, its economic and strategic power.

The Case for Diversification

Given the risks associated with Taiwan’s dominance in semiconductor production, the need to diversify the U.S. microchip supply chain is becoming increasingly urgent. One key solution is to boost domestic chip manufacturing. The U.S. government has already begun to take steps in this direction with the passage of the CHIPS and Science Act in 2022. This legislation provides billions of dollars in subsidies to companies like Intel, TSMC, and Samsung to build semiconductor manufacturing plants in the United States. These investments will help reduce dependence on foreign chipmakers and bring more production capacity to U.S. soil.

However, building out the necessary infrastructure and supply chains for domestic semiconductor production will take time. It requires not only large investments in manufacturing plants but also in research and development. In the long term, the U.S. will need to develop a robust ecosystem that supports the full lifecycle of chip production—from design and engineering to fabrication and testing.

In addition to increasing domestic production, the U.S. can diversify its supply chain by strengthening relationships with other countries involved in semiconductor manufacturing, such as South Korea, Japan, and European Union member states. By creating a more distributed global network for chip production, the U.S. can mitigate the risks posed by over-reliance on Taiwan. Strategic collaborations and partnerships with these countries could help ensure that the supply of microchips is more resilient to geopolitical disruptions.

What Needs to Be Done?

To secure a more resilient microchip supply chain, the U.S. must prioritize both short-term and long-term solutions. Domestically, continuing to invest in semiconductor manufacturing and research is crucial. The U.S. government should continue to incentivize private sector investment in semiconductor production, including through tax credits and subsidies. Companies like Intel, TSMC, and Samsung are already making moves to build new fabs in the U.S., but this shift will take years to complete, so continuous support and planning are essential.

In parallel, the U.S. should foster stronger international collaborations. By forming joint ventures with countries that already have semiconductor capabilities, such as South Korea, Japan, and the European Union, the U.S. can create a more distributed supply chain. This approach would help reduce the potential impact of any disruptions in Taiwan and provide more stability to the global semiconductor market.

Additionally, building a skilled workforce will be crucial. Semiconductor manufacturing is a highly technical industry that requires a specialized workforce. U.S. policymakers should focus on training and educating the next generation of engineers, scientists, and technicians to meet the demands of this growing industry. Without a skilled workforce, even the most advanced manufacturing facilities will struggle to thrive.

Conclusion

The U.S. cannot afford to remain overly reliant on Taiwan for its microchip supply. As global competition intensifies and geopolitical risks rise, diversifying the semiconductor supply chain is no longer optional—it’s a necessity. While steps have been taken through the CHIPS Act and other initiatives, a more comprehensive strategy is needed to ensure the U.S. remains competitive in the global technology race and can protect its economic and national security interests. By investing in domestic manufacturing, strengthening international partnerships, and fostering a skilled workforce, the U.S. can create a more resilient and secure microchip supply chain—one that ensures the country remains at the forefront of innovation for years to come.